China's automotive electronics market has set foot on a long road to recovery

Although it is widely believed that the global auto industry is one of the industries most severely hit by the current economic downturn, iSuppli's research shows that the Chinese auto electronics market may maintain a moderate growth even under such a severe situation. Where's the growth driver?

The main driving force for the growth of the Chinese automotive electronics market will come from the powertrain sector, which will benefit from the Chinese government’s economic stimulus plan. iSuppli Corporation predicts that the revenue generated by the Chinese powertrain market in 2009 will reach US$2.8 billion, an increase of 19.2% over 2008.

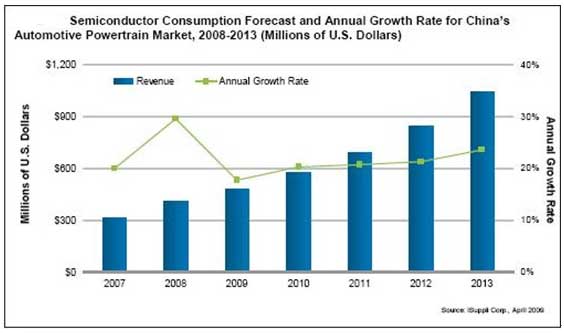

The engine management system (EMS) is the most important powertrain application. The growth momentum is expected to be stronger. In 2009, the shipment volume is expected to reach 10.2 million sets, which is an increase of 15.3% over 2008. Driven by the growth of the powertrain market, it is expected that the semiconductors consumed by the Chinese automotive powertrain market in 2009 will reach US$479.5 million, an increase of 17.7% over 2008. It is expected that sales will reach US$1.04 billion in 2013 and the compound annual growth rate for 2008-2013 will reach 22.1%.

Chart: Semiconductor consumption in China's auto powertrain market and prediction of compound annual growth rate

Short-term stimulus

According to China's national auto industry stimulus plan, from January 20 to December 31, 2009, auto purchase tax of 1.6 liters and below will be lowered to 5%. The stimulus plan will also arrange for a subsidy of 730 million U.S. dollars (about 5 billion yuan) to encourage farmers to abandon tricycles and slower trucks, replacing them with light trucks and small vans with a displacement of less than 1.3 liters. Only from March 1 to December 31, 2009 can these subsidies be enjoyed.

These preferential policies have created an immediate stimulating effect on the market. In the first two months of 2009, sales of small passenger cars surged, which was 18.8% higher than the same period in 2008. In 2008, the total sales volume of such vehicles was 3.1 million, accounting for 61.5% of the total passenger vehicle sales. Due to the tight supply, the price of some cars has even increased.

Newly-purchased tricycles and low-speed trucks in rural areas did not count toward total vehicle sales. In 2007, sales of such vehicles exceeded 2.1 million. The Chinese government’s 2009 purchase subsidies not only cover the newly-increased tricycles and low-speed trucks, but also cover the existing 7 million vehicles, totaling more than 9 million vehicles. The 5% replacement rate will bring 450,000 new consumption, which represents an increase of 4.8% over 2008.

Long term stimulation

Diesel passenger cars are very popular in Europe, but they are met with cold in China. According to the statistics of the German Automobile Industry Association (VDA), in 2006, 69.1% of new passenger vehicles in France were diesel vehicles. In Germany and Italy, the proportion was 58.4% and 64.7% respectively. However, in China, only 1% of passenger cars in 2008 were diesel vehicles.

The Chinese government has favored diesel technology in the past because it has advantages in energy saving and is a relatively mature technology. At that time, a national energy strategy was formulated to prepare vehicles using clean diesel. However, in the face of the global economic crisis, the schedule of the above plans has changed.

China is ready to use this opportunity to upgrade the entire industry supply chain. In the recently announced economic stimulus plan, the automobile authorities now regard electric vehicles and new energy vehicles as the main development direction. But iSuppli believes that in China, the outlook for diesel cars is far from as bright as in Europe.

In February this year, China’s economic stimulus plan stated that the government will implement a new energy vehicle strategy and promote the industrialization of electric vehicles and their key components. According to this deployment, the Ministry of Finance will provide subsidies to support the promotion of new energy vehicles in large and medium-sized cities in China. In the next three years, it will continue to invest approximately US$1.46 billion (10 billion yuan) in Chinese auto companies.

As Chinese auto companies gain R&D capabilities and government support for manufacturing, China's hybrid fuel and electric vehicles will accelerate development. iSuppli Corporation forecasts that the shipments of HEVs and EVs will reach 1.4 million and 448,000 vehicles by 2013, respectively. The hybrid fuel electronic control unit (HECU) will become a hot spot for investment in the Chinese powertrain market in the next five years.